The dollar list kept on bouncing back from earlier day misfortunes on Friday after U.S. government security yields rose on news that the Federal Reserve’s favored expansion measure showed costs proceeding to rise quicker than its 2% objective.

Unpredictability in the unfamiliar trade and loan cost markets has expanded over time around national bank activities and monetary information. One week from now could bring business as usual around strategy gatherings of the U.S. Central bank, the Bank of England and the Reserve Bank of Australia.

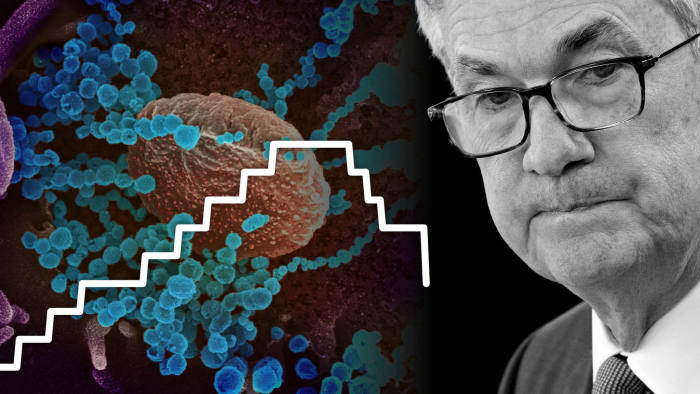

The Federal Reserve is relied upon to remove its first significant stage from the simple approach it set up to battle the pandemic, an achievement out and about back toward ordinary.

The Fed’s two-day meeting Tuesday and Wednesday is the large occasion for business sectors in the week ahead. The national bank is broadly expected to report that it will start to loosen up its $120 billion in month to month bond buys and end the program completely by the center of the following year.

Financial information will likewise be significant, with the October occupations report on Friday. There are many profit expected, including drugs like Pfizer and Moderna, just as a large group of movement, energy, protection, and tech organizations.

The euro, which has a substantial weighting in the dollar list, plunged 1.05% against the greenback the most since essentially June.

The euro’s drop helped drive the dollar list up 0.8% to 94.102 in the early evening in New York.

The fall in the euro more than switched its large increase the other day and came as brokers attempted to figure out expansion reports and national bank remarks to divine the course of loan fees for various monetary forms.

The euro likewise fell against the British pound by 0.4% and the Swiss franc by 0.7%.

Instability in the unfamiliar trade and financing cost markets has expanded over time around national bank activities and monetary information. One week from now could bring business as usual around strategy gatherings of the U.S. Central bank, the Bank of England and the Reserve Bank of Australia.

“A wellspring of unpredictability could be this disparity between the thing the business sectors are saying and what the national banks are saying,” said Marc Chandler, boss market planner at Bannockburn Global Forex.

The Bank of England additionally meets Thursday, and it is relied upon to raise financing costs. The move comes after rate climbs by South Korea, Norway and others.

“The Fed is essential for a worldwide move to eliminate convenience, and the market drives directly past that,” Bleakley Advisory Group CIO Peter Boockvar said. “As it were, the financial exchange is playing a risky game, with this swelling move and loan costs and the reaction from national banks.”

Expansion has been running at a 30-year high. Center PCE expansion which is the Fed’s favored check — hopped 3.6% in September on a year-over-year premise, as old as August.

Stocks were higher on the week, with the S&P 500 up around 1.1% starting at Friday evening and up generally 6.7% for the period of October. Both the Dow and S&P 500 scored new highs in the previous week. The broadly watched 10-year Treasury yield was at 1.53% Friday evening.

Jason Hahn is the authored many of the successful essay books and news as well. He is well-known for his writing skill. He currently lives in USA, with his wife. His profession is writing books and news articles. He is excellent as an author, currently he is working onboard with Insure Fied writer.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Insure Fied journalist was involved in the writing and production of this article.